Pakistan’s cyclical stocks might be in trouble!

Written by: InvestKaar

Anything that can go wrong will go wrong – the famous Murphy’s Law. This is exactly what’s happening with Pakistan today and may soon be eating into the profits of cyclical stocks.

Lets see why and how?

Here we go!

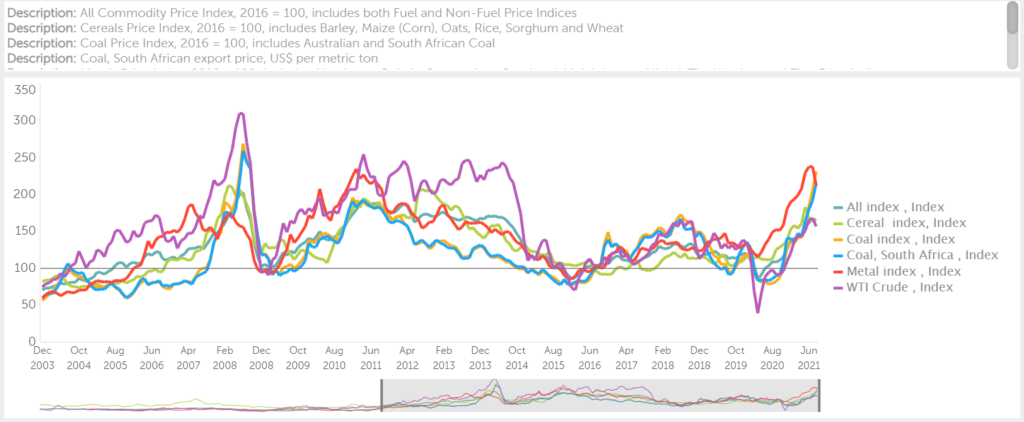

Oil up, gas up, coal up, steel scrap up, food commodities up, global transportation prices up, chip shortages amid no foreign investment inflows. And all of this is happening when Pakistan can least afford it.

Today we look at how did we reach here and what does it mean for cyclical companies’ profitability in 2HFY21E (July-Dec).

Prequel – the global context (if you know it already, skip to ‘Whats happening now’)

Every country wanted to come out of unemployment and negative growth rates post covid lockdowns. And all did the same through printing more money, stimulus cheques, and reducing borrowing costs for consumers.

What happened next?

Consumers started to spend on everything they could get their hands on! Initially, it all worked well. Companies had unsold inventories due to lockdowns. However, as soon as these companies reordered raw material, they couldn’t find it and when they could, global commodity skyrocketed. Result: price for everything and anything hit the roof (see the graph).

Prequel for Pakistan:

We were in a tough spot even before Covid. Growth was slow and unemployment was high and things started to go south really fast. To kickstart the economy, our government did exactly like the world by lowering DR. And it worked!

The only problem with Pakistan is, we don’t produce anything – we import everything either directly or indirectly (imported raw material for final goods). We say we are an agro-based economy, we aren’t. We can’t even sustain food produce without government intervention (more on this, some other day).

During the initial lockdown period, the entire world was locked down but we were still managing to export textile due to the government’s supportive policies for the export sector. So, for a short time, we became dollar rich. But as soon as the world opened up, the growth in exports started to slow down. In tandem, when Pakistan opened up, inflation went up and dollar supply became rare as credit got cheaper and we started to buy stuff (since everything we buy has high imported components).

So, what’s happening now?

Discount rates are low, so much so that we have negative real interest rates (DR minus inflation or 1.75%). To induce growth, SBP is pushing for new lending (TERF – cheap credit for industries to expand) and subsidizing consumer schemes like Apna Ghar, Apni Car, etc.

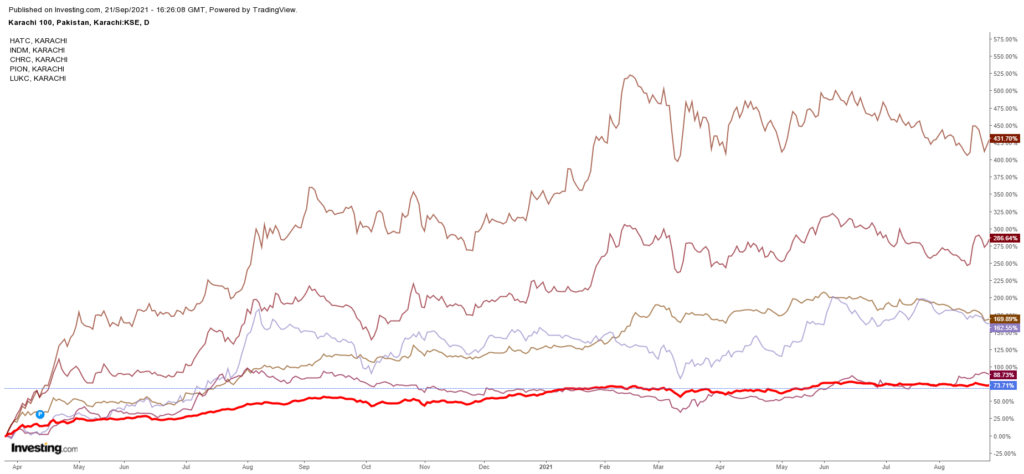

As a result, the industries are running in full swing and demand is outpacing supply in many cases. Take, for example, the recent global chip shortage crisis, local OEMs unable to meet demand, house prices making new highs, and cement plants running at 85-90% of their capacities (mind it, their capacities are 70% higher than what they were in FY19). In a nutshell, we are at the peak of our cycle, and listed cyclicals are killing it.

But can this continue? We don’t think so and here is why:

One can argue that finding companies that are cheap and of good quality (low earnings volatility, high margins) isn’t easy either. We agree! That’s why we came up with a broad checklist that will help you with the preliminary analysis:

The rise in global commodity prices is nowhere near close. Globally, coal is short, oil is short, gas is short, ships required to transport them are short and ports don’t have the capacity to entertain so many vessels. Even electronic chips are short which are used in almost everything.

Short means expensive! For the same number of products to import, we need more dollars now and the earnings stream for Pakistan isn’t growing as fast (the difference between dollar inflows and outflows for Aug21 was USD1.5bn – at this pace annual deficit may grow to USD18bn)

All of this is leading to higher inflation in Pakistan and have started to hurt buying power of consumers

Secondly, the government doesn’t want prices to go up! So, it is adding more and more commodities to the essentials list (recently added cement and cars to this list). This means companies producing them might not be able to pass on costs to consumers for some time.

Essentially this implies that businesses will have to absorb cost pressures in order to stay in business – doesn’t matter if they have to go in losses doing that

If this continues (and it seems so), we might see earnings deterioration in all such cyclicals in the upcoming quarter’s financials.

Sector-specific issues!

Cement companies may go in losses if they don’t increase cement prices (never thought of this happening given such high cement demand)

Auto companies have stopped taking orders for new cars since they don’t have chips to install in the vehicles. Moreover, since most of the components are imported, the rise in global transportation cost and rupee weakness against the dollar is also adding to the problem. (Many companies will have much lower sales and some might see losses)

Rising steel scrap prices mean steel manufacturers have to increases prices. Although they have passed on most of it already, it might not be enough – global steel scrap prices aren’t stopping

Gas is short and prices are up (more than 60% since Aug 2020) so companies that import LNG will have to increase prices to maintain profitability

What does it mean for valuations?

Companies need to increase their product prices while the government wants to keep them as it is or even fall to contain inflation and keep the growth cycle running. As the current rally was largely driven by cyclical, any impact on their profitability will be a major risk to overall market performance.

Though stock prices have come down to reflect these negatives and we are hearing that cement manufacturers and car assemblers might be increasing prices to maintain profits. However, if global commodities and freight keep increasing, it will be very hard for such cyclical companies to keep raising prices and maintain their profits.

Though we believe that dips should be considered as buying opportunities (detailed guide on it here!), we advise investors to keep a close eye on global commodity prices (oil, natural gas, coal) and Pak rupee to dollar parity to make their investment decisions.

Subscribe to InvestKaar: investkaar.com

InvestKaar - making investing easy

Signup to be a part of our aspiring investors' community

Thank you!

Welcome to the family!

You will not be disappointed!