Can dividend-only stocks make you rich in Pakistan?

Written by: InvestKaar

Most of you have been asking us to write on how to select a stock for investment. But before that you need to know your approach!

This is the first of three explainers on investment approaches in Pakistan

Investing can be as simple as putting money into your bank account and as hard as valuing a company with no revenues and no profits. But if you know what you want to do, every step from there becomes very easy. So, in today’s article we will explain to you the different investment approaches and where do they lie in terms of your time consumption and risk.

Not only that, we will give you a guide, as to what should you do, depending on your investing experience.

Let’s start!

in the past.

The prequel

There are a million ways to invest in the market – Google alone will show you some 377mn pages if you search for an ‘investment approach’. It’s considered to be the starting point of your journey, but in Pakistan, we only start to really think about it after a major loss.

Time to get it right and as always InvestKaar is here to help!

1. What is Income approach or Dividend only approach

This is the simplest, most basic, and least time-consuming. You don’t need a lot of finance/investment experience to do this.

The idea is to buy a stock with the highest dividend yield, hold it and keep getting dividends quarterly, semiannually (twice a year), or annually (once a year).

These companies are usually the ones with a sound operational history and steady income streams (growing as much as inflation or higher).

In Pakistan, you can find such companies in sectors like commercial banks, fertilizers, and some oil companies that are paying out high dividends on a quarterly basis – their dividend yields vary from 10%-16%.

Concept Checker # 1

What is dividend yield?

Formula: Cash dividends/Market price

Example: If FFC is paying a dividend of Rs3.5 per quarter. Annually, it becomes (Rs3.5 * by 4) Rs14/sh. If the price is Rs100 then Rs14/Rs100 = 14%

This means that if you have invested Rs100,000. You will get Rs14,000 annually or Rs3,500 per quarter before tax.

If you are a filer, the tax rate applied to dividends will be 15% otherwise 30%.

So, for a filer, after-tax annual dividend income becomes Rs11,900 (Rs14,000 divided by 1.15)

What to look for?

Dividend yield higher than inflation

Most of the time, high dividend-paying stocks don’t give any capital gains (when stocks prices go up – it’s called capital gains) so investors need to make sure that their dividend yields are higher than the current and forecasted inflation so that their wealth is protected.

Right now, inflation is within the 9.5-10% range and it is expected to reach 11-12% by January 2022.

So, you must choose a stock that has a dividend yield of 11-12%, so that you are covered for the medium term.

Sustainable payouts

For this, you need to screen for stocks that have a consistent and SUSTAINABLE payout.

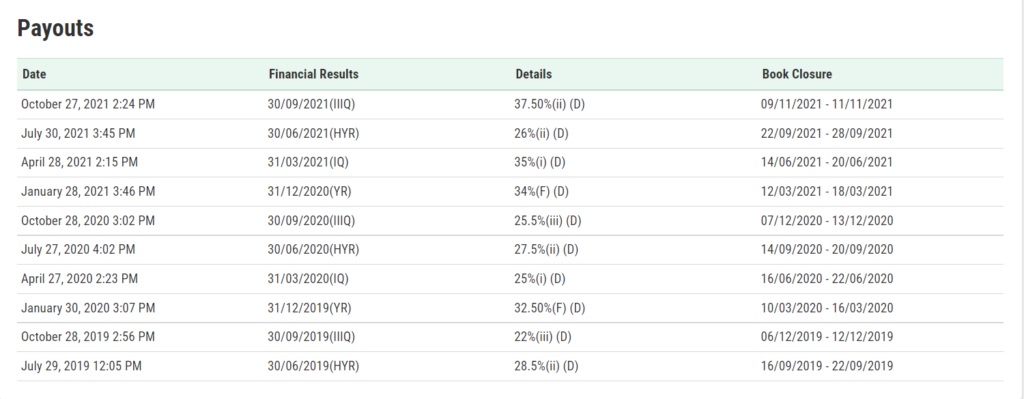

See we have highlighted the sustainable part. They should have a history of paying out dividends for at least three previous years. This will not include any company that has paid a one-time big dividend unless it’s an indication that the company will continue doing so (to gauge that, you will need some experience but it’s nothing to be concerned about today).

In our example, the FFC’s dividend yield is 14% so we are safe here.

Looking for historical dividends might seem a bit tedious but PSX’s website has made it easier. You can find historical dividend payouts for any stock here.

Benefits of Income / dividend yield strategy:

- No need to follow up on prices everyday – buy them once and keep a tab on just major developments, if any

- These are old and stable companies so there are high chances that they will continue paying out dividends for years to come

- You don’t need a lot of financial knowledge to read their books and forecast their profits

- Analysts do most of the work for you here, read up on brokerage reports to remain updated on the company’s financial position and its ability to pay out dividends.

Is there no chance of capital gains in a high dividend-yielding stock?

There is! But it happens when discount rates/inflation comes down. This is when people run after high dividend stocks and high demand means capital gains for existing investors.

Concept checker # 2

Dividend to interest rates differential

Interest rate is the return on money by the government of Pakistan when you keep money with them. This will be very close to inflation.

Let’s say the inflation is 10% and interest rates are 11%. This means without taking any risk, you can earn 11% if you put your money with the government through t-bills. Individuals can buy T-bills directly through an IPS account or through mutual funds (money market funds).

Now, if the risk-free returns are 11%, you require more when you take risks. By investing in the stock market, you are taking risks. So, the dividend yield has to be higher than the risk-free rate. In our example its, 14%. Here your interest rate to dividend yield differential is 3%. Remember this number!

Now see what happens when the inflation falls and the State Bank of Pakistan reduces interest rates. Say they reduce it to 8% from 11%. And if the average interest rate to dividend differential is 3%, the dividend yield will fall. A fall in dividend yield means an increase in stock prices.

By how much?

In our example, the FFC price should rise to Rs127/sh (Formula: dividend divided by risk-free rate plus dividend differential or Rs14 / (8% + 3%)

So, the capital gains to the existing investors can be as high as 27%

If you didn’t understand our concept checker, never mind.

Just understand this, if the interest rates come down meaningfully, your pure dividend stock will also rally like the market.

Is it this easy?

Yes!

Unfortunately, we have made the topic of investment difficult when it is clearly not.

If you are not sure, why not start with the smallest amount possible? See it working and then adopt it whole heatedly

Personal note:

In times like today, we will keep at least half of our investment in this category/approach. We don’t know when will the tough times end and we need our money to work the most for us during this time!

This is an easy approach and works best for people who invest for the long term and don’t want to be bothered by reading the market every hour every day.

This concludes the first part of our investment approach series.

The next approach is a mix of dividends plus capital gains – you will find it in your inbox soon!

Subscribe to InvestKaar: investkaar.com

InvestKaar - making investing easy

Signup to be a part of our aspiring investors' community

Thank you!

Welcome to the family!

You will not be disappointed!