What is the difference between Investments & Savings?

Savings is the money that is not spent and has been kept aside ‘safe’ either in a savings account, under the bed, or elsewhere. Investments refer to using these savings to buy assets that help you gain profit over some time.

Why is it essential to invest money?

You must have noticed that the prices of generally all items have increased every month or year. This is due to inflation. Inflation is a general rise in the prices of most goods and services. On average, the inflation rate for Pakistan is approximately 8%. This means that Sugar bought in PKR 100 today would cost PKR 108 next year, depending on the inflation rate. Let’s have a look at this table:

Value of Sugar today | PKR 100 |

Value of Sugar after a year | PKR 108 |

Value of your money if not invested | PKR 100 |

When, Why, and Where should I invest?

Investment not only enables a person to meet his financial goals but it also generates wealth and provides financial security in the long run. In every investment, the investor has to deal with some sort of risk. Risk is a possibility of either losing the profit or investment or both. You could lose the profit or invested amount because of the businesses not being able to generate revenue due to various market conditions. But a general principle of the investment is that the higher the risk, the higher the return. A Risk Profile is the level of the risk that you are comfortable with. The investor has three phases of investment, which are explained below:

- Young investors, i.e., those under the age of 35, are in the accumulation phase. Their ability to take risks is usually high, and they can majorly invest in stocks. Any significant loss wouldn’t harm them as they have time on their side to recover and start making a profit again.

- However, as you enter the preparation phase of life. i.e., when you are preparing for retirement and need income to support family expenses like children’s education and marriage, you become risk-averse and need stability in your investments.

- Further down the line in the retirement phase, you take the least risks as you are more focused on preserving your assets to maintain your lifestyle and bear expenses.

Can I start investing with a tiny sum of money?

Absolutely, you can start saving with whatever amount you are comfortable with. It could be PKR 500 a month. If you save some portion of your income and invest it somewhere, and then reinvest the return, you will be able to make a huge sum of money over some years. But how?

Let us take an example.

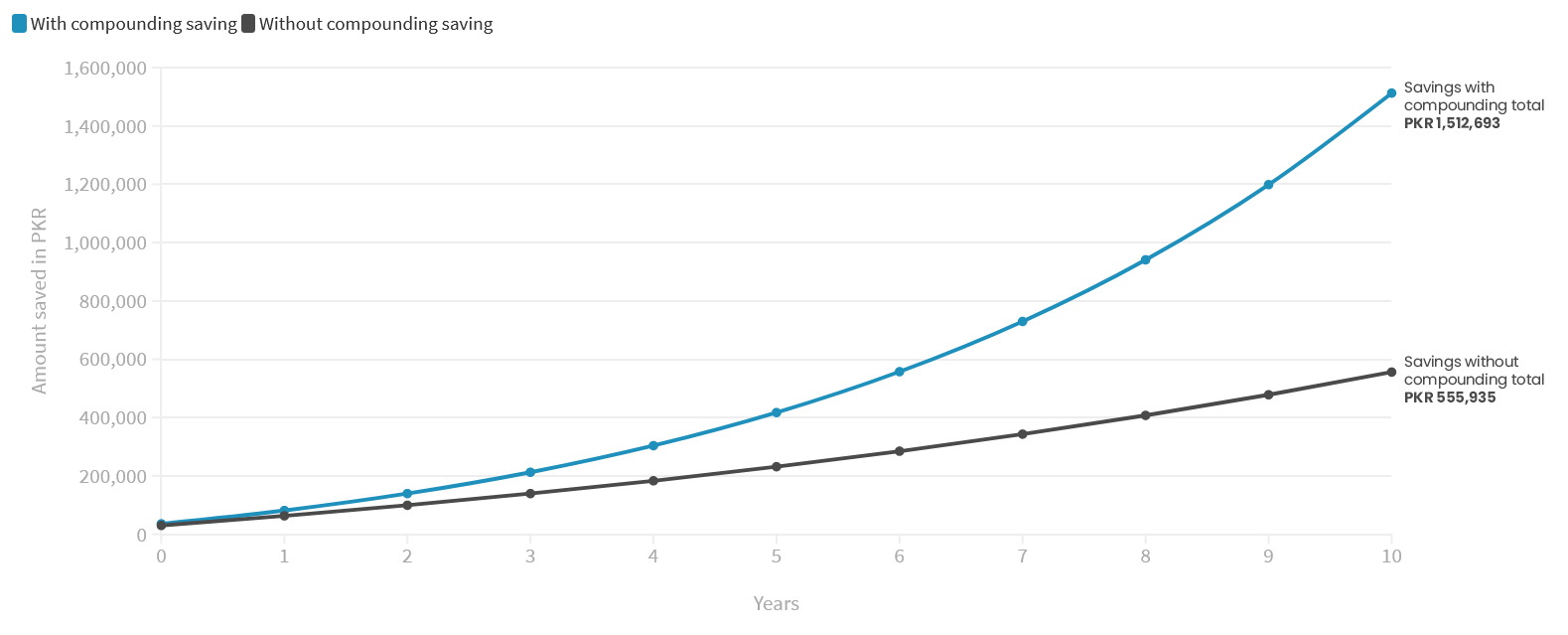

Assuming that you earn PKR 50,000 per month and save 5% of it. You also get a yearly increment of 10%. After 10 years, you will be able to save PKR 555,935.

However, if you choose to invest your saved amount for ten years with an yearly interest rate of 12% you will make around PKR 9.6 lakhs. Refer to the following graph for both of these calculations.

Savings with and without Compounding

Hence, if you reinvest, i.e., keep compounding your savings, you will be able to save a lot more money, giving you better security for foreseeable future.