What are securities?

In finance, Securities refer to financial instruments that hold a monetary value and can be interchanged with other instruments. There are different types of securities, but the two most common types are Equity and Debt. Equity security gives ownership to the shareholder, while Debt security represents money lent to a governmental or private institution to receive payments at exclusive interest rates till a specific date in the future where the total money lent is also paid back.

What are stocks and bonds?

A common example of Equity security is stocks/shares of the publicly listed companies that one can invest in to get ownership in the company. A private company becomes public when it issues its stocks for the public to buy. The transition is mainly done to raise capital for the company’s expansion. The said stocks can then be traded amongst investors on the Stock Exchange.

A typical example of a Debt Security is a bond, i.e., a fixed-income instrument representing a loan made by an investor to a borrower. These bonds can be issued by both governments and corporations to borrow money and raise funds. As explained above, a bond would include the terms of the loan, variable or fixed interest amount, and the maturity date when the loan’s principal is due to be paid to the bond owner.

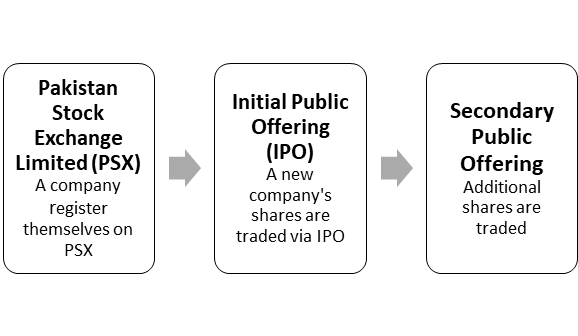

What happens when a new company is listed on PSX?

As mentioned earlier, a company can raise money by issuing either shares/stocks or bonds. The above chart shows how the company issues its shares. After the company is registered on PSX, it then offers its stocks to the general public. This process of offering is called IPO, Initial Public Offering. Hence, if a company wants to issue additional shares, they are administered via Secondary Public Offering. Interestingly, PSX can not only trade shares but bonds as well. In this way, the company raises the capital in return for fixed periodic payments as mark-up and the eventual return of principal to the investor.

What is a stock exchange, and how is it managed?

A stock exchange is a platform where shares can be publicly traded. For Pakistan, there is only one stock exchange called PSX, Pakistan Stock Exchange, where the shares of public listed companies are bought and sold daily. Several institutions like CDC, NCCPL, SECP work together to ensure its smooth functioning. The stocks are delivered via Central Depository Company (CDC) and settled through the National Clearing Company of Pakistan Limited (NCCPL). Securities Exchange Commission of Pakistan(SECP) keeps check and balance on the overall process of the stock exchange, making sure that all rules and regulations are being followed.

However, not everyone has to personally deal with these bodies to trade stocks; they can simply contact a broker to get involved in the stock market. They can contact the Trading Right Entitlement Certificate holder or any licensed brokerage firm to hire a broker. For example, the broker for FinPocket is Fortune Securities, which is a licensed and registered firm with PSX and SECP.