Why penny stocks are rallying now?

Written by: InvestKaar

Penny stocks or low cap stocks that are generally priced between Rs10-20/sh, have gained a lot of popularity in recent years. These stocks generate a lot of interest due to their ability to turn small sums into large gains. As investors, we all have been enticed to invest in such stocks, committing relatively smaller capital and waiting and hoping for a turnaround story to emerge to realize large gains.

These small-cap stocks do become all the more popular when discounts rates are low – remember the rally in 2007 or 2016 or 2021? We try to explain the reasons behind this in our blog today.

Keep reading to understand.

DR impacts all but penny stocks more:

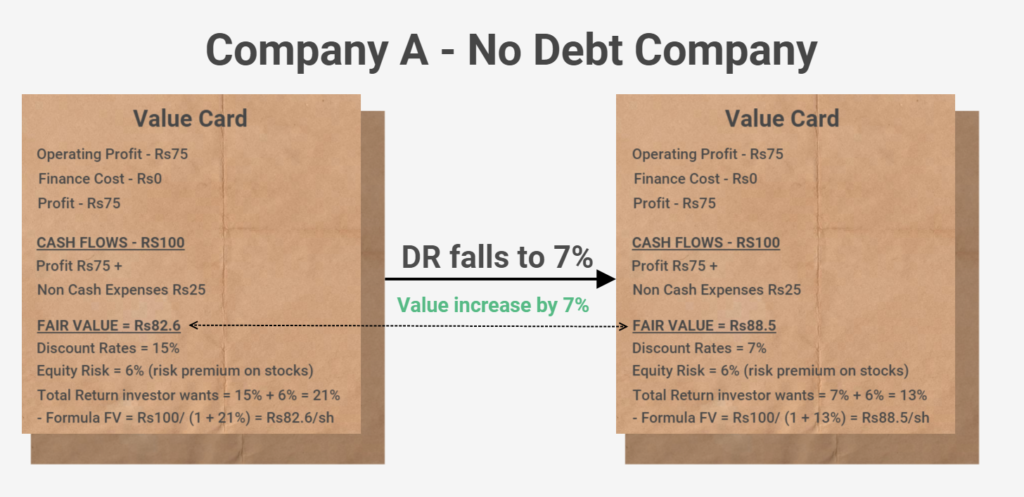

Changes in DR impact all the stocks due to the discounting principle at work. Simply put, a company’s fair value will increase in a lower interest rate scenario and vice versa. Let us show you how?

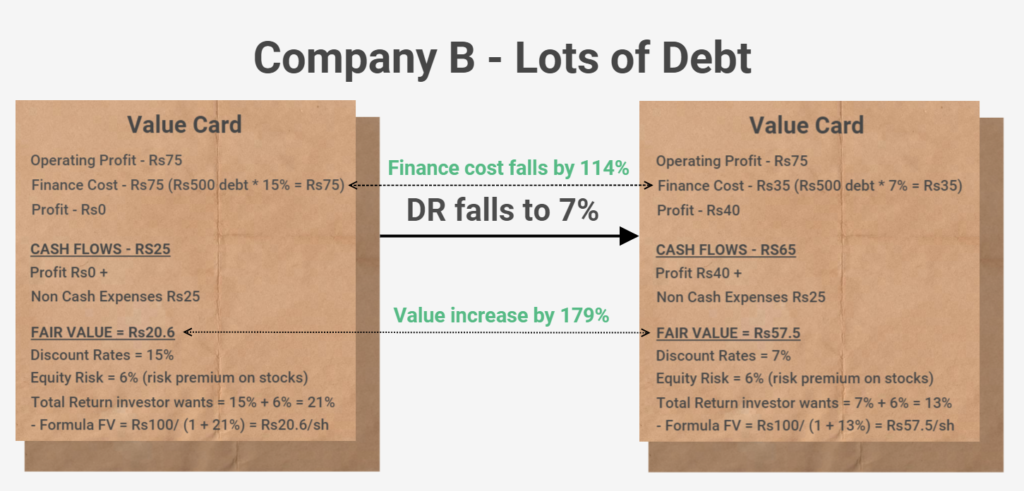

Now in case of a penny stock, that has high debt:

- Penny or low-priced stocks are usually characterized by high debt levels and when discount rates are high, they pay a lot of their income to banks as interest.

- At 15% discount rate, this company will have to pay Rs75/sh as interest alone. This leaves only Rs25/sh for shareholders. For comparison, company A had Rs100/sh for shareholders.

- Now say the discount rates come down to 7%, they now have to pay only Rs35 as interest – its halved. But see how much money is now left for shareholders – Rs65/sh as compared to Rs25 when DR was high.

- Take a moment to comprehend the difference. This is 2.6 times more for shareholders vs when the discount rates were high.

- So, all in all, more money means more valued the stock is and this is the prime reason why penny stocks rally when discount rates come down.

See the concept play out in 2021

Discount rates in Pakistan have come down by 6.25% over the last 2 yrs and are projected to remain the same until the end of 2021. During this time, we observed that penny stocks have outperformed the index by a good margin and provided more return to the investors.

Take a look at the chart below to see that small-cap stocks do much better in terms of price-performance in a lower interest rate scenario.

And that’s not all – low DR pushes investor to take risk

In a country like Pakistan where inflation is high, the return on investments lowers across major asset classes when DR lowers – think, saving certificates, bank deposits. So, investors try to make up for lower returns by taking on a little more risk – placing bets on something a little bit riskier, but with bigger return potential.

This is what’s happening right now in Pakistan. Inflation is 9% and returns on deposits are 4% so safe investments are losing appeal as they are unable to even protect capital, let alone grow it.

Conclusion

Investing is tricky and if you consider penny stocks – well it becomes a lot more difficult. Since penny stocks are typically smaller and more volatile companies, it doesn’t take a lot to throw them off course. So, one has to be extremely cautious, well-informed and on top of their game to make money by trading in such stocks.

We advise you to dedicate a portion of your investment portfolio – a number that you are comfortable with and consistent with your risk appetite – to such stocks. Begin with two or maybe three stocks at a maximum and take out time to understand their business model, management, and growth angles carefully. The amount of time you commit to doing your homework properly will be directly proportional to the return you make.

Please note that this piece is for information purposes and should not be considered trading advice or investment strategy. Penny stocks are considered speculative with high risks of loss of capital so speak to your traders/planners for a strategy

Subscribe to InvestKaar: investkaar.com

InvestKaar - making investing easy

Signup to be a part of our aspiring investors' community

Thank you!

Welcome to the family!

You will not be disappointed!